E-invoice

Improves business efficiency and increases tax compliance

About E-invoice

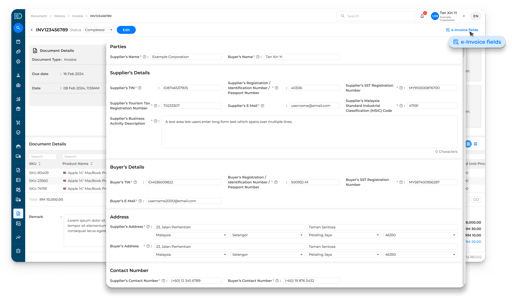

An e-Invoice is a digital representation of a transaction between a supplier and a buyer. e-Invoice replaces paper or electronic documents such as invoices, credit notes, and debit notes. It contains the same essential information as traditional document, for example, supplier’s and buyer’s details, item description, quantity, price excluding tax, tax, and total amount, which records transaction data for daily business operations.

The implementation of e-Invoice not only provides seamless experience to taxpayers, but it also improves business efficiency and increases tax compliance.

Key Challenges in E-invoice Journey

Setup Time & Effort To Meet Regulatory Compliance

There are 50+ fields as required by the authority, and some of the required information might not be readily available in the current system. Enhancing & populating those data would means more change request & implementation cost.

Not to mention there are about 8API which involve invoice, credit notes, refund etc that need to be taken care of.

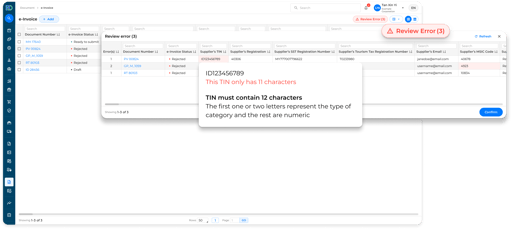

Data Correctness & Status Of Document Submission

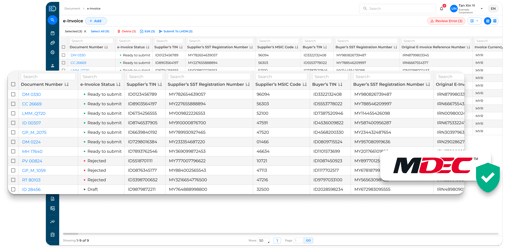

The authority runs multiple check for the data submitted. It will lead to increase in your current finance & order processing workflow if data are not checked before sent to the tax authority as this will lead to multiple time of back & forth.

You might also need to monitor the status of the documents submission if there is any issue of the submission which again will lead to additional work & time spent.

Monitor & React To Ongoing Change From Tax Authority

Once launched, it is inevitable there will be on going change from the tax authority. Example of the change might be from additional data required, change of data format or the business flow from the authority.

There is going to be a need to keep monitoring those changes to ensure your company continue to be in compliance with the regulation.

Key Challenges in E-invoice Journey

Data Enrichment

We allow you to preset repeat fields that is needed by the tax authority but is not available in your existing ERP / DMS system. This can help to save you time & cost. This allow you to not making changes on your legacy system, or mass edit / update your master data which might not be the most efficient & effective way to handle this eInvoice need.

Data Check, Submission Notification & Auto-Retry

Our system perform pre-check and flag you errors before sending the data to the tax authority.

We will also be notifying you on the status of the document submission and save you time via our automated resubmission algorithm hence keeping you hassle free to ensure data is submitted in a timely manner.

Closely Working With The Authority

Being a SAAS solution meaning we will be having our system certified by the authority, and we ensure all changes are reflected in a timely manner

Elevate Customer Experience

Your business now can significantly improve the operational efficiency & customer experience by combining eInvoice module with Boostorder Rep as well as Boostorder Direct solution.

.png?width=610&height=256&name=MicrosoftTeams-image%20(12).png)